by Jakob Straub

Updated on March 3, 2023

Buying a house in Switzerland is an ambitious undertaking, which is why expatriates living in this Alpine country usually start by renting. But for some, Switzerland’s stunning nature and pristine cities can make buying a more attractive option If you’re set on buying a Swiss property, there are a few important things to know and consider. Our step-by-step guide to buying a house in Switzerland has all the details.

The Swiss market for renting and buying a property is competitive. It’s also a bit complicated: Switzerland is a country of 26 cantons, and varying regulations may apply to the housing market in each. As an expat, you should also be aware that purchasing a property doesn’t entitle you to a residence permit on its own.

Foreign nationals may need authorization to buy a property, depending on their nationality or residence status. This regulation exists to prevent foreigners from buying up the country and leaving nothing left over for the Swiss. Also note that you’ll need to purchase the property in a real human’s name; it’s not possible to buy a house in the name of a company.

Bureaucracy seems to be one of the many official Swiss languages as restrictions apply at the national, regional and local levels. But there are some cases in which you don’t need additional authorization to buy:

All foreign nationals living outside of Switzerland require authorization to buy property. Expats living in Switzerland who are non-EU / EFTA nationals must seek authorization to buy:

You need a residence permit to live and work in Switzerland. Without it, you can only buy a residential property in a designated tourist area and not in Zurich, Basel, Geneva or any of the Swiss Cities. Without a residence permit, you can only occupy your property for up to six months per year.

Switzerland is an expensive country with a high cost of living. The housing market reflects this. On average, the property price per square meter is around 13.000 CHF in the city center and around 9.000 CHF outside of it. For Zurich, the price per square meter climbs to over 19.000 CHF in a central location and over 11.000 CHF outside of the city center. Just like in any other country, buying a house in a village in Switzerland is cheaper than the city. For Geneva, in the French-speaking part of the country, the prices for each location type are around 16.500 CHF and 11.500 CHF, respectively.

If you’re planning on financing your purchase with a mortgage, you’ll need at least 20% of the asking price as a down payment—plus an extra 5% to cover fees and taxes. Fortunately, the transaction fees are relatively low when you buy a house in Switzerland:

Your net income will determine the buying price of a property you can afford, as your bank will take it into account for the mortgage. (This doesn’t apply if you plan to purchase your home in cash.) After a down payment of 20%, the value of the mortgage will be around 80% of the home’s price. Keep in mind that this figure does not include interest and additional costs; the bank will add up the amortization, maintenance and any other costs, which together will likely be around 6%.

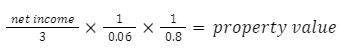

As a general rule of thumb, these costs should not total more than one-third of your net income. To afford a property with a value of 500.000 CHF, for example, it’s best to have a stable annual net income of at least 72.000 CHF. This is the formula for the property value:

The way to your dream house in Switzerland is a long process, but we’ve broken it down to help you avoid setbacks.

Using our formula above, you can calculate the value of the property you can afford based on your net income. Unless you’re planning to pay the lump sum for your house in Switzerland in cash, you’ll want to arrange a mortgage with your bank, a mortgage broker or a lender.

Calculate your price range with our tips above to see which property you can afford. Define your wants and needs, i.e. your negotiables and non-negotiables. These may include:

Once you have your parameters clear, you can start searching on online real estate portals or with the help of a local real-estate agency or agent.

Because the market is competitive, once you’ve found a property that interests you, make an appointment to visit as soon as possible. Compare the actual, real house to the listing and have a list of questions ready to ask. Try not to reveal your maximum budget to the owner or agent right away, especially if it may exceed the value of the actual home you’re interested in. And don’t appear too eager to buy, as playing it cool may ultimately help you land the best deal.

When you’ve found a place you want to call your own, you’ll make a bid with the agent or directly to the seller. Typically, you’ll have to show proof of financing at this stage, i.e. a mortgage agreement or a letter from your bank stating they will loan you the required amount.

The reservation contract is the first step towards actually owning the house you want to buy in Switzerland. It is binding for both parties and includes a deposit ranging from several thousand Swiss francs to tens of thousands. This amount is applied towards the down payment for the property.

With the sales price in writing, the next step is to complete the financing. You can take your housing deal to your bank or mortgage lender to fill in the details in your financing contract. If you are indeed paying cash, you’ll work out the transfer and documentation with the seller.

In Switzerland, a notary commonly manages the sale on behalf of the buyer and seller. They will look at your authorization (if required), help you apply for it and prepare the deed of sale. Once you’ve signed the deed, the notary will help with the mortgage registration and writing the sale into the land register. Though this can take up to several weeks, you’ll usually receive the keys and the property before that.

Once your new house is finally yours, you’ll have to negotiate property insurance to cover cases such as fire, flooding and natural disasters. This is mandatory, though home insurance for your possessions and third-party liability insurance are both optional. You’ll also have to connect utilities such as water, electricity, internet and cable.

Switzerland is among the healthiest countries in the world. This fact, along with the country’s rich culture and unique traditions, contributes to the competitiveness in the Swiss housing market.

Let’s briefly recap the steps and considerations involved in buying a house in Switzerland:

As you can see, buying a home in Switzerland can be a complex ordeal. But with a bit of persistence and an eye on the bigger picture, you may just be able to make your Swiss dream come true.